The 5 Most Common Claim Denials and How to Avoid Them

🕒 Updated on Last Modified Date

When it comes to running a private practice, few things are more frustrating than an insurance claim being denied. You’ve provided the care, documented everything carefully, and submitted the claim—only to receive a notice that it wasn’t paid. Sometimes the reason is clear. Other times, it’s hidden behind a vague denial code that makes little sense.

The most common claim denials in private practice don’t just delay payments but they also create hours of additional work—tracking, calling, appealing, and resubmitting claims that should have been paid the first time. The good news? Most denials are preventable. Once you understand why they happen, you can set up systems to catch these issues before they reach the payer.

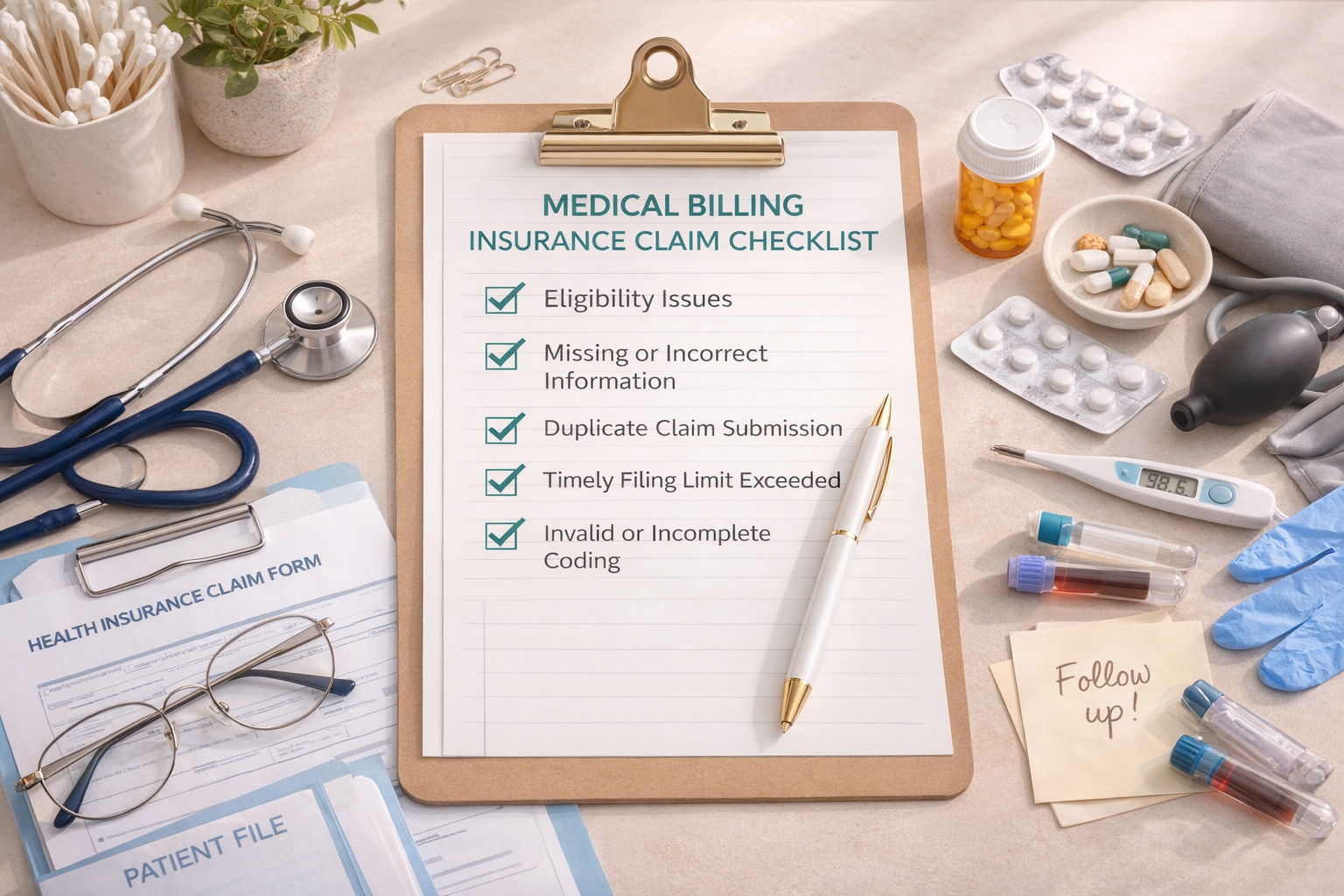

Here are the five most common reasons insurance claims get denied and what you can do to stop them from happening in your practice.

❌ 1. Eligibility Issues

What it means:

The patient’s insurance coverage wasn’t active on the date of service or their plan doesn’t cover the specific service you billed.

Why it happens:

This is one of the most frequent causes of claim denials. Patients may switch jobs (and therefore plans), lose coverage, or forget to update their information with you. In some cases, the provider may not be in-network for the plan, or the plan requires prior authorization or a referral that wasn’t obtained.

How to avoid it:

- Always verify benefits before the first appointment, and again at the start of a new year or benefit period.

- Use real-time eligibility tools through your clearinghouse or the payer’s provider portal.

- Confirm whether the patient’s plan requires pre-authorization or referrals—especially for mental health and specialty visits.

- Document the verification date, representative name, and reference number for your records.

Pro tip: For recurring patients, recheck benefits every 90 days to avoid surprises when a plan changes midyear.

❌ 2. Missing or Incorrect Information

What it means:

There’s missing or mismatched information on the claim that prevents it from being processed.

Why it happens:

Even a single typo can trigger a denial. Common culprits include the patient’s date of birth, subscriber ID, or policy number entered incorrectly, or a mismatch between the patient’s name on the claim and the payer’s file. Errors in the rendering provider’s NPI, taxonomy, or address can also cause claims to bounce back.

How to avoid it:

- Double-check all demographics and insurance information at intake.

- Compare what’s entered in your EHR against the patient’s insurance card—don’t assume it’s correct.

- Use your billing software’s claim-scrubbing tool to catch errors before submission.

- Keep provider details (NPIs, taxonomy codes, addresses) updated in your EHR, CAQH, and with payers.

Accurate information is the foundation of a clean claim. Taking a few extra minutes up front can prevent weeks of payment delays.

❌ 3. Duplicate Claim Submission

What it means:

The insurance company believes the same claim was already submitted, so it’s denied as a duplicate.

Why it happens:

Sometimes providers resubmit a claim because they haven’t seen payment yet—without realizing the first submission is still processing. Other times, billing software automatically re-triggers claims when a payment isn’t posted quickly enough.

How to avoid it:

- Track submission dates carefully and monitor claim statuses in your clearinghouse.

- Don’t resubmit a claim until you’ve confirmed whether it’s still pending or was never received.

- When you must resubmit, mark the claim clearly as a “Corrected Claim” with the original claim reference number.

Duplicate denials can slow processing even further, so clear tracking and documentation are key.

❌ 4. Timely Filing Limit Exceeded

What it means:

The claim was filed after the payer’s submission deadline.

Why it happens:

Every payer has its own timely filing limits—some as short as 90 days from the date of service. If you miss the window, the claim will automatically deny, and most payers will not make exceptions unless there’s proof of a system or eligibility error.

How to avoid it:

- Submit claims as soon as documentation is complete—ideally within 48–72 hours of the visit.

- Use a billing log or spreadsheet to track filing deadlines by payer (e.g., BCBS = 180 days, Cigna = 90 days, etc.).

- Don’t wait until the end of the month to batch claims; frequent submission keeps cash flow steady.

- Regularly check clearinghouse rejections to catch issues before the clock runs out.

❌ 5. Invalid or Incomplete Coding

What it means:

There’s an issue with the diagnosis (ICD-10) or procedure (CPT/HCPCS) codes, or the modifier required by the payer is missing.

Why it happens:

This often occurs when codes are outdated, mismatched, or don’t align with the payer’s policy. For example, a telehealth session may require a specific place-of-service code or modifier that’s missing. Or the CPT code billed doesn’t match the provider’s license level or specialty.

How to avoid it:

- Use current-year CPT and ICD-10 manuals or verified EHR coding libraries.

- Review payer policies for covered codes and modifier requirements (especially for telehealth).

- Confirm that your provider credentials match the scope of the codes being billed.

- Double-check that diagnosis codes support the medical necessity for each service.

Proper coding ensures that claims don’t just go through—but that they get paid correctly.

Pro Tip: Always Read the Explanation of Benefits (EOB)

Every denial includes a reason or adjustment code. Reading your EOBs or ERAs carefully helps you spot patterns and take corrective action before the same problem repeats.

If something doesn’t make sense, don’t hesitate to call the payer. Ask for a clear explanation, take note of the representative’s name, and document every call. The details you gather can be invaluable for appeals or future training.

Tired of Chasing Down Denials?

If this list sounds familiar, you’re not alone and you don’t have to do it all yourself. As a medical billing specialist, I help private practice providers:

- Reduce denials through cleaner claim submissions

- Get paid faster with proactive follow-ups

- Stay organized with clear, timely reporting

- Focus more on patient care and less on insurance paperwork

Whether you need full-service billing or just support cleaning up old denials, expert help can make a world of difference.

If you’re tired of dealing with the most common claim denials in private practice, outsourcing billing can help you reduce errors and get paid faster. Curious what that support could look like for your practice? Let’s connect! I’d be happy to review your current billing workflow and share how I can help.